Inflation is the rise in average price levels in an economy, usually over a period of one year. My first glimpse of a significant impact on inflation came at the beginning of the New Year, where an analyst predicted that inflation will continue to drive down high PE stocks over the course of 2021. He picked the likes of JP Morgan, Oracle and SPDR Energy ETF. JP Morgan and Oracle are still trading with PEs in their mid teens, while the energy sector companies in the S&P 500 have held a 10 year average PE of 11.9, the lowest out of all industries.

At the moment, interest rates are at historic lows, almost 90 basis points lower than pre-covid levels. In theory, low interest rates mean cheap money, in financial terms, a very low cost of capital. This means that discounting of future cash-flows reduces, and the effect is dramatic when this effect is compounded over 5,10 or 15 years. Due to this, we have seen growth stocks like Square, Match Group and Tesla reach astronomic PE ratios, as the value of their future cash-flows skyrocketed over the past year.

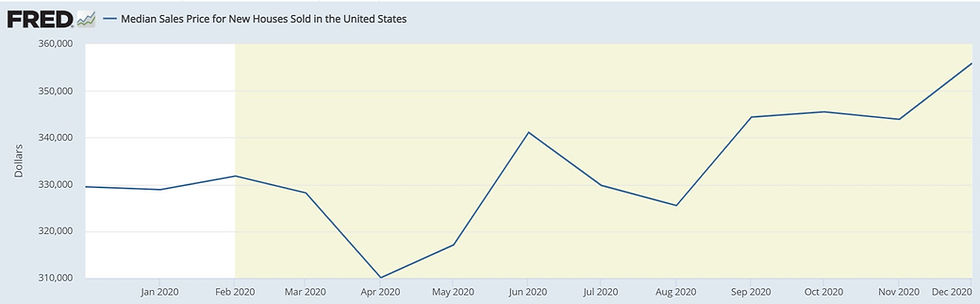

Linking this back to the analyst prediction, he stated that inflation, which has been 'non-existent' for the past 20 years, is creeping back in. For example, US home prices reached all time highs in in Q4 2020, rising about 7% YoY. Furthermore prices of industrial metals like copper, zinc, tin and aluminium have all been up 20%+ since pre-covid levels. Let's look at food prices. Corn prices have risen around 30% in the past 1 year, while the overall food and beverages Consumer Price Index has risen about 3% since pre-covid levels. According to the fellow analyst's views, he predicts a steep increase in inflation, which in turn will force the government to increase interest rates. As this occurs, the astronomical valuations of rocket stocks will vanish overnight.

Although predicted inflation levels are relatively low for now, with most sources claiming that even the trillions of dollars of government funding, isn't enough to offset the loss in aggregate demand due to the pandemic. If inflation does hit and the price hikes reach consumers, Wall Street may see itself in an epidemic of its own.

Let's consider the last time we witnessed extreme inflation levels alongside negative economic growth, in 1973. As an amalgamation of the 1973 Oil Crisis, alongside the Nixon Shock, which abolished the gold standard, and directly interfered with free-market prices and wages for the first time since the second world war, inflation rates reached over 12% and economic growth slumped at a -2%. Over the period of the next year, our indexes lost over 45% in value...

To conclude, we are most certainly going through a very turbulent time in the global economy. Economic growth was negative in the trailing year, while the price of certain commodities are rising at unprecedented rates. We are not sure whether we are witnessing inflation levels sky-rocket, however an intelligent investor may find it helpful to create a defensive position against the downside of such an occurrence.

Comments